The Challenges and Strategies of Securing Seed Funding for Startups

October 24, 2024 | by Tomiwa Aghedo

For startup founders, raising capital can be a daunting task. In addition to creating a product, building a team, and driving revenue, it is crucial to secure funding to ensure the business thrives.

If you are embarking on your seed funding journey, here’s a comprehensive guide to help you navigate the process:

Understanding Seed Funding

Seed funding refers to the initial capital that startups raise to launch their business ventures. This early stage of financing is crucial for turning innovative ideas into reality and laying the groundwork for future growth. Following the seed round, startups typically pursue additional funding through subsequent rounds such as Series A, B, and C.

The Purpose of Seed Funding

The primary goal of seed funding is to provide founders with the resources needed to validate their ideas and explore market opportunities. Investors at this stage are often focused on helping companies achieve “product-market fit,” a concept articulated by Marc Andreessen, who describes it as being in a favorable market with a product that meets consumer demands. Seed rounds can vary significantly in size and objectives depending on individual companies and investor preferences.

Timing Your Seed Funding Round

Knowing when to seek seed funding is critical. Founders should approach investors when they have a solid product, a clear market opportunity, or a dedicated team capable of cultivating a venture that attracts venture backing. Y Combinator suggests that founders should raise funds once they understand their target market and have developed a product that meets customer needs with promising adoption rates—typically around a 10% weekly growth over several weeks.

If you believe your venture has strong potential for substantial returns, it might be time to initiate your fundraising efforts.

Steps to Successfully Raise Seed Funding

A strategic approach is imperative for effective fundraising. Similar to developing a sales and marketing funnel, establish a systematic process for raising capital. This process can be broken down into three main stages:

- Attracting Potential Investors: Actively seek out qualified investors through outreach efforts, warm introductions, and attracting inbound interest. Ensure that these investors align with your ideal profile—considering factors such as industry focus, development stage, geographical location, and investment capacity.

- Nurturing Relationships: While you may not be closing deals continuously, it’s essential to maintain engagement with potential investors year-round. Staying on their radar through regular updates and outreach will yield advantages when you are ready to raise capital.

- Building Strong Investor Relationships: Just as customer satisfaction is vital for retention, establishing rapport with current investors is equally important. They act as your most significant advocates, and new investors often seek insights from those already invested in your company.

Your goal should be to actively funnel investors through this process, culminating in a successful funding round.

Types of Seed Funding Sources

Several options exist for securing seed funding, primarily focused on venture capital, but also including:

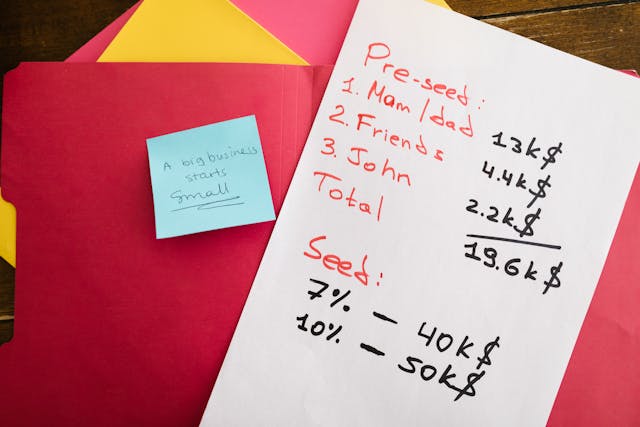

- Friends & Family: Often the first source of funding, this method relies on personal networks and typically requires less formal engagement.

- Crowdfunding: Platforms such as Republic and StartEngine allow startups to raise capital from the public, enabling contributions as small as $100.

- Non-Traditional Firms: Innovative financial institutions like Earnest Capital focus on sustainable businesses, offering unique funding structures such as Shared Earnings Agreements.

- Incubators: These programs support startups by providing resources, mentorship, and sometimes, seed funding to address common startup challenges.

- Accelerators: Similar to incubators but with a structured program, accelerators provide funding in exchange for equity and help established businesses evolve through targeted support.

- Angel Investors: Individuals looking to diversify their portfolios often provide early-stage funding and can bring valuable experience to the table.

- Corporate Seed Funding: Large companies are increasingly creating venture arms to invest in promising startups that align with their growth strategies.

The Timeline for Raising Seed Capital

Securing seed funding can be a lengthy endeavor. Industry expert Brett Brohl from Bread & Butter Ventures proposes a timeline that includes:

- One Month: Preparing documents and compiling a list of potential investors.

- Three Months: Actively pitching and engaging with investors.

- One Month: Finalizing agreements and due diligence with selected investors.

Much like Brohl’s “1-3-1” rule, the typical period for raising seed capital can range from three to nine months.

Financing Options for Seed Rounds

Navigating the various financing options available during seed rounds can feel overwhelming. Generally, these options fall into two main categories:

- Convertible Debt & SAFEs: These have become prevalent in recent years, allowing startups to delay the valuation process. Y Combinator popularized SAFEs, providing developers with standard templates for use.

- Equity Financing: Although less common than in the past, pure equity financing involves setting a firm valuation and offering shares to investors in return for capital.

We advise consulting a legal expert to determine the best financing options tailored to your business’s unique needs.

By understanding these elements and implementing structured strategies, founders can enhance their chances of successfully securing seed funding

Related resources:

RELATED POSTS

View all