Securing venture capital for a startup from an investor can be challenging. In addition to having a viable business or product, it’s essential to have a strategic approach for reaching out and engaging with investors throughout the fundraising process.

At Switch Capital, we often liken a venture fundraising campaign to a traditional B2B sales strategy. You begin by adding investors to the top of your funnel, nurturing relationships through meetings, emails, and presentations, and ultimately aiming to close the deal at the bottom of the funnel.

Creating a Strategy for Investor Outreach

Fundraising can resemble a sales cycle, so it’s vital to develop a systematic approach to connect with potential investors—just as you would for prospective clients. Here’s a step-by-step guide to streamline your investor outreach:

- Understand the Market

Before anything else, it’s crucial to grasp the market landscape to articulate why an investor should support your business. Understanding the target audience you’re selling to will significantly aid in building your investor list. - Research Your Target Investors

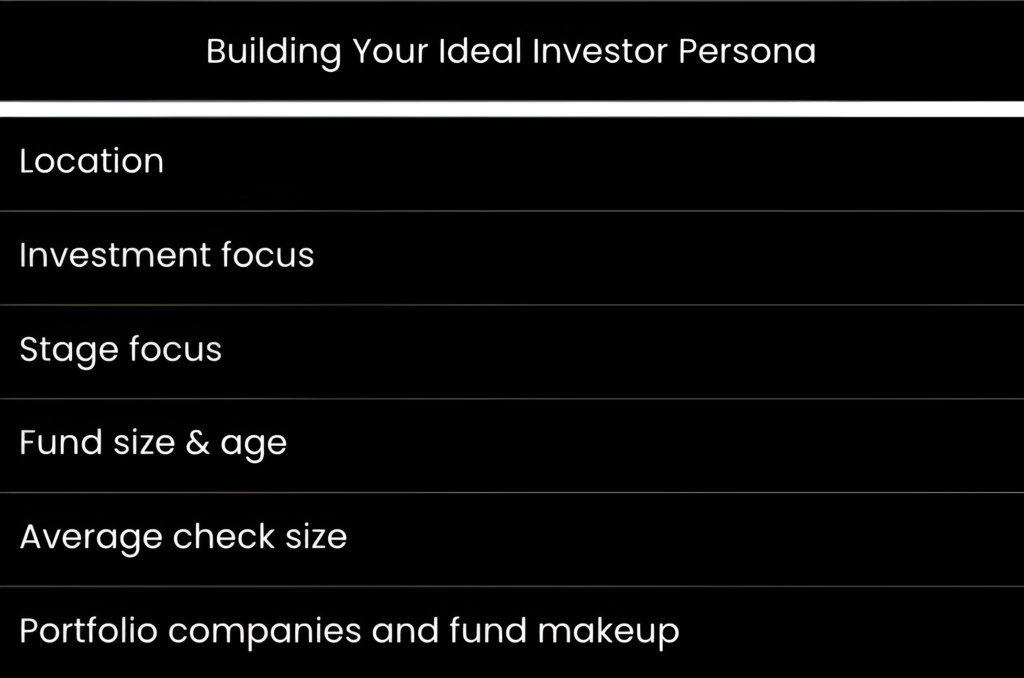

Similar to identifying potential customers, compile a list of investors who match your fundraising goals. This task may require dedicated time as fundraising can become a full-time commitment for many founders. Consider criteria such as:- Geographic location

- Market focus

- Funding stage

- Check size

- Fund size

- Existing portfolio makeup

- Compile a List of Prospective Investors

Once you know your ideal investor profile, start creating a comprehensive list. Founders should typically connect with at least 60 investors during their fundraising efforts, though this number can vary based on individual circumstances. - Craft Your Outreach Email or Template

With your list in hand, begin drafting personalised outreach messages. Striking the right balance between personalisation and focus is vital for effective cold emails. - Initiate Your Outreach

After preparing your materials, it’s time to start reaching out to investors. A useful strategy is to group investors into batches to refine your approach as you engage with them, allowing you to adjust your pitch based on initial feedback. - Prepare Marketing Materials and a Pitch Deck

Investor requests for different assets will arise during the fundraising process, so it’s advisable to have these materials ready beforehand. Early preparation can enhance your responsiveness and effectiveness in conversations with potential backers. - Follow Up With Investors

An effective outreach strategy includes a plan for following up. If there’s no response after a week, reach out again. If you’ve had previous communication, setting expectations for follow-up can keep your connections active. - Monitor Engagement Through Metrics

Tracking investor interest is crucial. Pay attention to email engagement data to determine which investors are actively interested in your offering, allowing you to focus your efforts accordingly. - Engage in Meaningful Conversations and Close Deals

If you’ve done your research and targeted the right investors, you should have constructive discussions that can lead to successful outcomes. Not every investor will say “yes,” so stay committed and continue fostering strong conversations.

Effective Platforms for Investor Outreach

Similar to customer outreach tools, several platforms can enhance your investor outreach efforts:

- Email

Reaching out via email is a prevalent method for connecting with potential investors, as they are accustomed to receiving cold inquiries from founders. - LinkedIn and Twitter

Social media can both enhance visibility and engage investors. Many founders have found success using these platforms to share their journeys and attract interest. - Phone Calls

While cold calling may not be the strongest channel for initial outreach, it can be effective for follow-up conversations after establishing prior rapport.

By leveraging these strategies, you can enhance your chances of successfully securing the funding your startup needs.

Related resources:

RELATED POSTS

View all