What is Pre-Seed Financing? A Startup Founder’s Guide

October 1, 2024 | by Tomiwa Aghedo

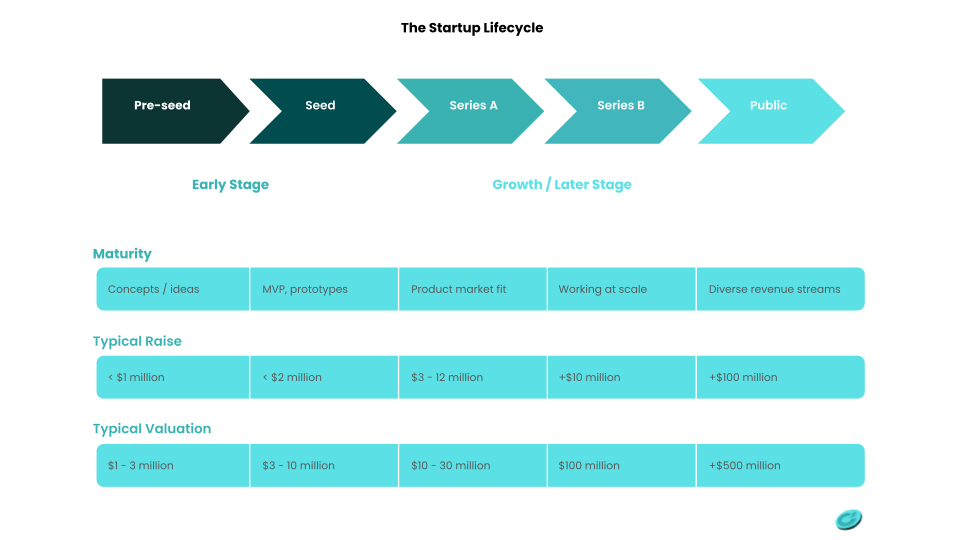

If you’ve been paying attention, you may have noticed that seed funding rounds increasingly exceed their previous sizes. This observation not only reflects reality but also highlights a significant trend in the startup ecosystem.

Historically, amounts ranging from $500,000 to $1 million qualified as substantial for seed deals. However, today, we often see seed rounds exceeding $5 million.

As Elizabeth Yin, the founder of Hustle Fund, expressed, “In San Francisco, I’m seeing significant party rounds for seed funding—ranging from $3 million to $5 million. Moreover, there are even instances of $10 million rounds raised right from the onset! A friend of mine, an accomplished serial entrepreneur with a successful exit, recently secured $8 million at a post-money valuation exceeding $30 million, all with just a preliminary version of her product. Consequently, investors eagerly invested, resulting in her round becoming oversubscribed”.

Today’s definition of a seed round has become increasingly subjective. It is now common to encounter terms such as pre-seed, seed plus, or seed extension. Additionally, the rising size of traditional seed rounds has contributed to the growing popularity of pre-seed rounds. While pre-seed rounds have existed for years, they now see more frequent utilization.

What is Pre-Seed?

In essence, a pre-seed round represents an initial funding round that typically lacks institutional investors or involves minimal investment, often under $150,000. This funding stage ultimately enables startups to further develop their products and devise strategies to achieve substantial revenue.

How to Raise a Pre-Seed Round

To successfully raise a pre-seed round, a few criteria should be met:

- There’s some form of proof of concept or an early product available.

- The market has indicated a clear need for the proposed product or solution.

An intriguing aspect of securing a pre-seed round is the likely absence of substantial traction or metrics. In contrast to later funding rounds that tend to emphasize performance data, financials, and benchmarks—along with aspects like product, market, and team—pre-seed rounds focus more on innovative concepts and long-term vision.

With limited traction, the founding team becomes even more crucial. If a founder possesses a solid track record despite a lack of traction, it can simplify the decision process for pre-seed investors. Conversely, if there is no traction and no relevant experience, obtaining a pre-seed round becomes significantly more challenging. It’s essential to effectively pitch your vision, demonstrate your capability to build a product, and outline your total addressable market.

Closing a pre-seed round marks only the beginning of your entrepreneurial journey. Successfully utilizing the acquired funding to develop your product, sell to customers, and attract top talent will be essential for securing future funding rounds, such as seed and Series A.

RELATED POSTS

View all